Summary

Switzerland is an excellent place to start a business, offering stability, a strong economy, and a supportive environment for entrepreneurs. By following the steps outlined in this guide, you can navigate the process with confidence and set your business up for success.If you’re ready to take the next step, start by gathering the necessary documents, researching your market, and reaching out to local professionals who can assist you with the legal and financial aspects of your new venture.

This guide will walk you through everything you need to know to set up a business in Switzerland, from choosing the right legal structure to understanding the local market.

Table of Content

- Why Switzerland

- Choosing the Right Business Structure

- 5 Misconceptions

- Disadvantages of Setting Up a Company in Switzerland

- Step-by-Step Guide to Company Formation

- Understanding Legal and Regulatory Requirements

- Banking and Financial Setup

- Funding Options

- Understanding the Local Market and Culture

- Government Support and Incentives

- Office Space and Real Estate

- Networking and Professional Support

- Conclusion

Why Switzerland?

Switzerland isn’t just about stunning landscapes and high living standards. It’s also a global business hub with low corporate taxes, a highly skilled labour force, and a solid legal system that ensures the protection of intellectual property.The country consistently ranks high in global competitiveness, making it an attractive destination for both local and international entrepreneurs.

Choosing the Right Business Structure

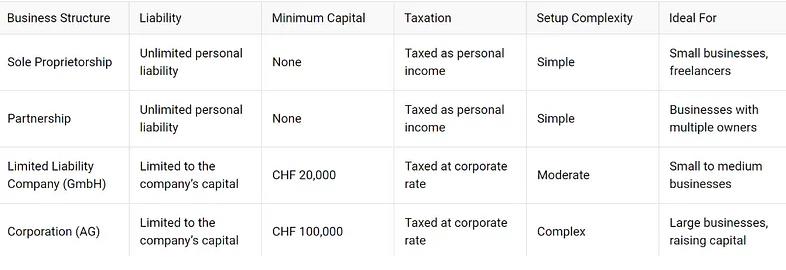

Before you dive into the registration process, it’s essential to choose the right legal structure for your business. Switzerland offers several options, each with its own advantages and requirements:- Sole Proprietorship: Ideal for small businesses or freelancers. It’s simple to set up, but the owner is personally liable for all debts.

- Partnership: If you plan to go into business with one or more partners, this might be the right choice. Like a sole proprietorship, partners are personally liable.

- Limited Liability Company (GmbH): A popular choice for small to medium-sized businesses. It provides limited liability protection, meaning your personal assets are separate from the business.

- Corporation (AG): Best suited for larger businesses or those planning to raise significant capital. It offers the most robust liability protection.

Misconceptions

Setting up a business in Switzerland can be an exciting venture, but there are some common misconceptions that can lead to confusion or unrealistic expectations. Let’s clear up five of these misunderstandings with the real facts.Switzerland is Only for Large, International Corporations

While Switzerland is home to many multinational giants, it is also very friendly to small and medium-sized enterprises (SMEs). The country offers a stable economic environment, favourable tax rates, and an efficient regulatory system that benefits businesses of all sizes. Many entrepreneurs choose Switzerland for its innovation ecosystem, particularly in sectors like finance, tech, and healthcare.Starting a Business in Switzerland is Extremely Expensive

Although Switzerland has a reputation for being a high-cost country, setting up a business isn’t as expensive as people think. The cost largely depends on the type of business and location. For example, setting up a simple GmbH (similar to an LLC) requires a minimum share capital of CHF 20,000, which is comparable to or even less than many other European countries.Moreover, Switzerland’s high efficiency, skilled labour force, and quality infrastructure often lead to higher productivity, which can offset initial costs.

The Process is Slow and Bureaucratic

Switzerland is known for its efficiency, and the business setup process is no exception. It typically takes just a few weeks to establish a company if all the paperwork is in order. The country’s well-structured legal and administrative systems are designed to facilitate business operations rather than hinder them.The online processes for registering businesses, paying taxes, and even obtaining work permits are straightforward and streamlined.

You Must Be a Swiss Citizen or Resident to Start a Business

Switzerland is open to foreign entrepreneurs. While having a Swiss resident as a director can be necessary depending on the business structure, many foreign nationals start businesses without needing citizenship. In cases where a local director is required, there are professional services that provide this at a reasonable cost.Switzerland has favourable visa policies for entrepreneurs, especially those who bring innovation or significant investment.

Switzerland’s Tax System is Too Complex and Burdensome

Switzerland’s tax system is complex, but not necessarily burdensome. The country has one of the most attractive corporate tax regimes in Europe, with rates varying by canton (region). Companies can benefit from tax incentives, especially those involved in research and development.Switzerland’s double taxation treaties with numerous countries help avoid the risk of being taxed twice, making it an attractive destination for international businesses.

Disadvantages of Setting Up a Company in Switzerland

Setting up a business in Switzerland can be highly attractive for many reasons, but it’s not without its challenges. Here are five disadvantages you might face:- High Costs

Switzerland is one of the most expensive countries in the world. The costs associated with setting up and running a business here, including salaries, office space, and living expenses, are significantly higher than in many other countries. This can be a barrier, especially for startups or small businesses with limited capital. - Strict Regulatory Environment

Switzerland has a very rigorous and complex regulatory framework. Navigating the legal and bureaucratic requirements can be time-consuming and costly. For instance, there are strict rules on employment, environmental regulations, and financial reporting, which can be overwhelming, especially for businesses unfamiliar with Swiss laws. - Language Barriers

Switzerland has four official languages: German, French, Italian, and Romansh. Depending on the canton where you set up your business, you’ll need to adapt to the local language, which can pose challenges for communication, marketing, and hiring. This can also increase the costs of translation services and make it harder to integrate into the local market. - Small Domestic Market

While Switzerland is economically strong, its domestic market is relatively small. With a population of just over 8 million, businesses might find limited opportunities for growth within the country itself. This makes it essential to focus on international markets, which can increase the complexity and costs of operations. - Banking Secrecy and Taxation Issues

Switzerland’s reputation for banking secrecy is both a blessing and a curse. While it attracts certain types of businesses, it also means increased scrutiny and compliance requirements from international authorities. Additionally, Switzerland’s tax system, although advantageous for many, is complex and can be challenging to navigate, especially with the ongoing changes due to international pressure on tax practices.

Step-by-Step Guide to Company Formation

Setting up a business in Switzerland involves several key steps:- Market Research and Business Plan

Start by researching the market to understand your competition, target audience, and potential demand for your product or service. A solid business plan is crucial, as it will guide your strategy and help you secure financing. - Choosing a Company Name

Select a unique name that reflects your brand and complies with Swiss naming regulations. Ensure that the name isn’t already in use by another company. - Registration Process

- Draft the Articles of Association: This document outlines the structure and governance of your company.

- Public Notary Involvement: For GmbHs and AGs, the Articles of Association must be notarized.

- Register with the Commercial Register: This step officially registers your company and makes it a legal entity in Switzerland.

- Obtain a VAT Number: If your business is expected to generate more than CHF 100,000 in revenue, you’ll need to register for VAT.

- Timeline and Costs

The process of registering a company in Switzerland is straightforward but can take a few weeks, depending on the business structure. Costs vary, with a sole proprietorship being the least expensive to establish, while a corporation can be more costly due to notary fees and initial capital requirements.

Understanding Legal and Regulatory Requirements

Switzerland has a transparent and efficient legal system, but there are still several regulatory requirements you must meet:- Business Licenses and Permits: Depending on your industry, you may need specific licenses to operate legally.

- Tax Obligations: Switzerland’s tax system is attractive, with relatively low corporate tax rates. However, you must comply with both federal and cantonal tax requirements.

- Employment Laws: If you plan to hire employees, familiarize yourself with Swiss labour laws, including contracts, minimum wage, and social security contributions.

Banking and Financial Setup

You’ll need a valid company registration and proof of identity. Switzerland’s banking system is renowned for its security and discretion, making it a reliable choice for your business finances.Funding Options

If you need financing, Switzerland offers various options, including bank loans, venture capital, and government grants. The right choice will depend on your business’s size, industry, and growth plans.Understanding the Local Market and Culture

Swiss professionals value punctuality, precision, and clear communication. Building relationships and trust is crucial, so take the time to get to know your business partners and clients.Switzerland has a diverse and affluent consumer base. Local preferences can vary significantly across the country’s different regions, so tailor your marketing strategies accordingly. Conduct thorough market research to understand local buying habits and trends.

Government Support and Incentives

The Swiss government actively supports businesses through various grants, subsidies, and tax incentives. Additionally, there are numerous incubators and accelerators that can help startups grow, especially in tech and innovation sectors.Office Space and Real Estate

Finding the right office space in Switzerland depends on your business needs and budget. Major cities like Zurich, Geneva, and Basel offer a range of options, from co-working spaces to prime real estate.Renting can be expensive, so it’s essential to factor this into your budget.

Networking and Professional Support

Switzerland offers a well-established network of chambers of commerce, trade associations, and business groups. Joining these networks can provide valuable connections and support as you establish your business.Professional services like lawyers, accountants, and consultants can guide you through the complexities of Swiss business law and tax regulations.

Think starting a business in Sweden is all about high taxes and red tape? Think again! Our article guides you through the advantages of Sweden’s stable economy and innovative environment. Learn how to leverage these for your startup or expansion!

Dreaming of starting a business in the luxury lanes of Monaco? It's not just for the glitterati! Discover the real Monaco—a haven for savvy entrepreneurs! We debunk common myths and show you how to start a thriving business amidst the luxury.