Summary

Monaco offers an exceptional environment for businesses, combining a strategic location with a high standard of living and a business-friendly tax system. By following the steps outlined in this guide, you can successfully navigate the process of setting up your business in Monaco.If you’re ready to move forward, start by researching the market, preparing your business plan, and seeking advice from local experts who can guide you through the legal and financial aspects of establishing your business in Monaco.

Known for its political stability, luxurious lifestyle, and favorable tax policies, Monaco offers a unique blend of business and pleasure.

In this guide, we’ll walk you through the essential steps and considerations for starting a business in Monaco.

Table of Content

- Why Monaco?

- Choosing the Right Business Structure

- 5 Misconceptions

- Disadvantages of Setting Up a Company in Monaco

- Step-by-Step Guide to Company Formation

- Understanding Legal and Regulatory Requirements

- Banking and Financial Setup

- Funding Options

- Understanding the Local Market and Culture

- Government Support and Incentives

- Office Space and Real Estate

- Networking and Professional Support

- Conclusion

Why Monaco?

Monaco is synonymous with wealth, and for good reason. The principality has no income tax, low business taxes, and a highly developed infrastructure.It’s a prime location for those looking to tap into the European market while enjoying the benefits of a prestigious address. Monaco’s strategic location on the Mediterranean coast, coupled with its stable government and secure banking system, makes it an ideal spot for setting up a business.

Choosing the Right Business Structure

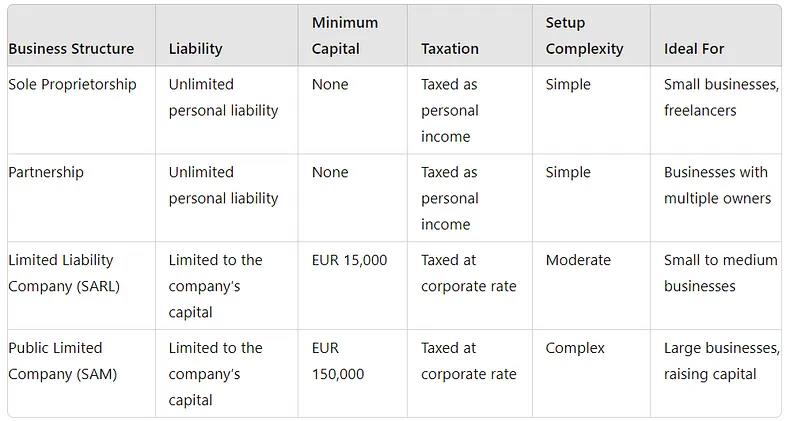

Before registering your business in Monaco, it’s crucial to choose the right legal structure. The structure you choose will impact your tax obligations, the complexity of setup, and your personal liability. Here’s a breakdown of the main business structures available:- Sole Proprietorship: This is the simplest form of business structure, ideal for individuals who wish to start a small business or work as freelancers. However, it comes with unlimited personal liability, meaning your personal assets could be at risk if the business incurs debt.

- Partnership: If you’re planning to start a business with one or more partners, a partnership might be the right choice. Like a sole proprietorship, it’s easy to set up but carries unlimited personal liability for the partners.

- Limited Liability Company (SARL): A SARL is one of the most common business structures in Monaco. It offers limited liability protection, which means your personal assets are separate from the business’s debts. This structure requires a minimum capital of EUR 15,000 and is suitable for small to medium-sized enterprises.

- Public Limited Company (SAM): Best suited for larger businesses, a SAM requires a significant initial capital investment of EUR 150,000. It offers robust liability protection and is ideal for companies looking to raise capital through public investment.

Misconceptions

Setting up a business in Monaco is an appealing option for many entrepreneurs due to its reputation for wealth and luxury. However, there are several misconceptions about the process. Let’s break down five of these misunderstandings and explain the real situation.Monaco is Only for the Ultra-Wealthy

While Monaco is indeed known for its wealthy residents and high-end lifestyle, it is not exclusively for the ultra-rich. Monaco actively encourages entrepreneurs and businesses of various sizes to set up operations within its borders.Although the cost of living is high, the principality offers numerous incentives, particularly for businesses in finance, technology, and luxury industries. Moreover, Monaco’s government is keen on fostering innovation and entrepreneurship, offering support and resources to new businesses.

The Cost of Setting Up a Business in Monaco is Prohibitively High

It’s true that Monaco is one of the most expensive places in the world, but the costs associated with setting up a business can be more manageable than expected.The initial costs, such as office rental and registration fees, vary widely depending on the business type and location within Monaco. However, the low corporate tax environment and absence of personal income tax for residents can make it financially viable in the long run.

Additionally, Monaco offers a business-friendly legal framework that can make the setup process smooth and efficient.

Monaco’s Business Environment is Overly Bureaucratic

Although there is a process to follow, Monaco is known for its efficiency in handling business registrations. The requirements are clearly outlined, and the process is designed to be straightforward, though it can take a few months to complete depending on the complexity of the business.The government has streamlined many procedures, particularly for sectors they wish to promote, such as finance, tech, and luxury goods. Hiring local experts to assist with the process can also help navigate any bureaucratic hurdles more effectively.

Only Residents Can Start a Business in Monaco

You do not need to be a resident of Monaco to start a business there, but the process is easier if you are a resident or if you appoint a local resident as a director.Many foreign nationals set up businesses in Monaco while living elsewhere. The principality also has provisions for granting residency to entrepreneurs and investors, which can simplify business operations and provide additional benefits, such as personal tax advantages.

Monaco’s Tax Benefits are Just for Wealthy Individuals, Not Businesses

Monaco’s tax benefits extend to businesses as well. While Monaco is famous for not having personal income tax for its residents, businesses also benefit from a favorable tax regime.For example, Monaco does not impose direct corporate taxes on profits unless more than 25% of the turnover is generated outside Monaco, making it highly attractive for local operations.

This tax advantage, combined with the principality’s stability and prestigious reputation, can make Monaco an excellent base for international business.

Disadvantages of Setting Up a Company in Monaco

Setting up a business in Monaco can seem like a glamorous choice due to its wealth and prestige, but there are several challenges that prospective business owners should be aware of. Here are five disadvantages:- High Costs of Living and Business Operations

Monaco is synonymous with luxury, and this is reflected in the cost of living and doing business. Office rent, salaries, and general operational costs are extremely high compared to most other locations.

This can put significant pressure on businesses, particularly startups or smaller companies, to manage their budgets effectively. - Limited Local Market

With a population of around 39,000 people, Monaco’s local market is very small. This limitation means that businesses can’t rely solely on local customers for growth and must target international clients or tourists, which can require additional resources for marketing and distribution. - Strict Regulatory Environment

Monaco has a complex and strict regulatory framework, especially for certain sectors like finance and real estate. The process of registering a business can be cumbersome, requiring various approvals from government authorities.

Compliance with local laws can be a time-consuming and costly process, particularly for businesses unfamiliar with the local legal environment. - Challenging Labor Market

Monaco’s small size and high cost of living make it difficult to attract and retain talent. The local labor market is limited, and hiring skilled employees can be challenging.

Don’t forget about the legal requirements for hiring, such as work permits and residency obligations, add another layer of complexity that businesses must navigate. - Residency and Nationality Restrictions

Obtaining residency in Monaco is a complex process, and without residency, it’s challenging to set up and manage a business effectively.

There are also restrictions on who can own and run businesses in certain sectors, with some industries requiring Monegasque nationality or residency. This can limit opportunities for foreign entrepreneurs and add another barrier to entry.

Step-by-Step Guide to Company Formation

Setting up a business in Monaco involves several steps, each requiring careful attention to detail:- Market Research and Business Plan

Start by conducting thorough market research to understand your competition, target audience, and potential demand. A well-crafted business plan will serve as your roadmap and is essential for securing financing and government approval. - Choosing a Company Name

Select a name that reflects your brand and complies with Monaco’s naming conventions. The name must be unique and not already in use by another company. - Registration Process

- Draft the Articles of Association: This document outlines your company’s governance and must be notarized by a Monégasque notary.

- Obtain Government Approval: Before registering, your business plan and Articles of Association must be approved by the Monaco government.

- Register with the Trade and Industry Registry: Once approved, your company must be registered with the Trade and Industry Registry to obtain legal status.

- Obtain a Business License: Depending on your business activity, you may need to apply for specific licenses.

- Timeline and Costs

The process of setting up a business in Monaco can take several weeks to a few months, depending on the complexity of your business structure. Costs vary, with a sole proprietorship being the least expensive to establish, while a SAM involves higher costs due to capital requirements and government approvals.

Understanding Legal and Regulatory Requirements

Monaco’s legal system is clear and business-friendly, but there are specific regulations to be aware of:- Business Licenses and Permits: Certain industries require specific licenses to operate, such as financial services or real estate.

- Tax Obligations: Monaco offers favorable tax conditions, including no income tax for residents. Corporate taxes are low, but businesses must comply with both local and international tax obligations.

- Employment Laws: If you plan to hire staff, it’s important to understand Monaco’s labor laws, including employment contracts, minimum wage, and social security contributions.

Banking and Financial Setup

Opening a business bank account in Monaco is a critical step. You’ll need to provide your company’s registration documents and proof of identity. Monaco’s banking system is highly secure, offering a range of services tailored to international businesses.Funding Options

Monaco has a variety of funding options, from traditional bank loans to private investors. The right choice depends on your business needs and growth strategy.Understanding the Local Market and Culture

Monaco’s business culture is professional and formal. Building trust and maintaining strong relationships are key to success. The local market is characterized by high purchasing power, but also by demanding consumers who expect top quality and luxury.Monaco’s population includes both wealthy residents and an influx of tourists, particularly during events like the Monaco Grand Prix. Understanding the preferences and expectations of these diverse consumer groups is crucial for your business.

Government Support and Incentives

Monaco offers a supportive environment for businesses, including various incentives and grants for startups, particularly in the tech and finance sectors. Additionally, the government actively promotes innovation and entrepreneurship through local incubators and accelerator programs.Office Space and Real Estate

Office space in Monaco is highly sought after, particularly in prime locations like Monte Carlo. Real estate prices can be high, so it’s essential to factor this into your business plan.Consider whether a co-working space or a traditional office is more suitable for your needs.

Networking and Professional Support

Monaco has a well-established network of business professionals, including chambers of commerce and industry-specific associations. Joining these networks can provide valuable connections and resources.It’s also advisable to work with local professionals, such as lawyers and accountants, who understand the intricacies of Monégasque law and business practices.

Think starting a business in Sweden is all about high taxes and red tape? Think again! Our article guides you through the advantages of Sweden’s stable economy and innovative environment. Learn how to leverage these for your startup or expansion!

Busting myths about starting a business in Switzerland! From legal structures, advantages, misconceptions to local markets, our guide reveals why Switzerland is a top choice for entrepreneurs and how to set up your business