Whether you’re a savvy investor or just curious about global incomes, this guide provides a fascinating comparison that blends finance with a global perspective.

Why Coca-Cola?

Coca-Cola is not just a household name; it is a symbol of consistent performance and reliability in the stock market. Known for its iconic beverages, Coca-Cola has also built a reputation as a stellar dividend payer.Coca-Cola’s journey as a dividend payer began in 1920, marking over a century of rewarding its shareholders. Throughout the decades, even during economic downturn, Coca-Cola has not only maintained but also steadily increased its dividend payouts.

For 62 consecutive years, Coca-Cola has increased its annual dividend. This impressive streak is a rare achievement and places Coca-Cola among a select group of companies that have managed to grow their dividends for such an extended period.

From modest beginnings, the dividend has grown significantly, adapting to changing economic landscapes and ensuring shareholders receive a reliable income. For example, in 2024, Coca-Cola announced a 5.4% increase in its quarterly dividend, raising it to $0.485 per share.

This consistent growth, averaging around 5% annually in recent years, ensures that investors not only receive regular income but also benefit from the power of compounding over time.

Warren Buffett’s Endorsement

Renowned investor Warren Buffett, often referred to as the “Oracle of Omaha,” is a firm believer in the long-term value of Coca-Cola shares.Through his company, Berkshire Hathaway, Buffett has held a substantial position in Coca-Cola for decades, showcasing his confidence in the company’s ability to generate consistent returns.

Buffett’s endorsement is not just about the financials; it’s about Coca-Cola’s enduring brand power, strategic growth, and reliable dividend payouts.

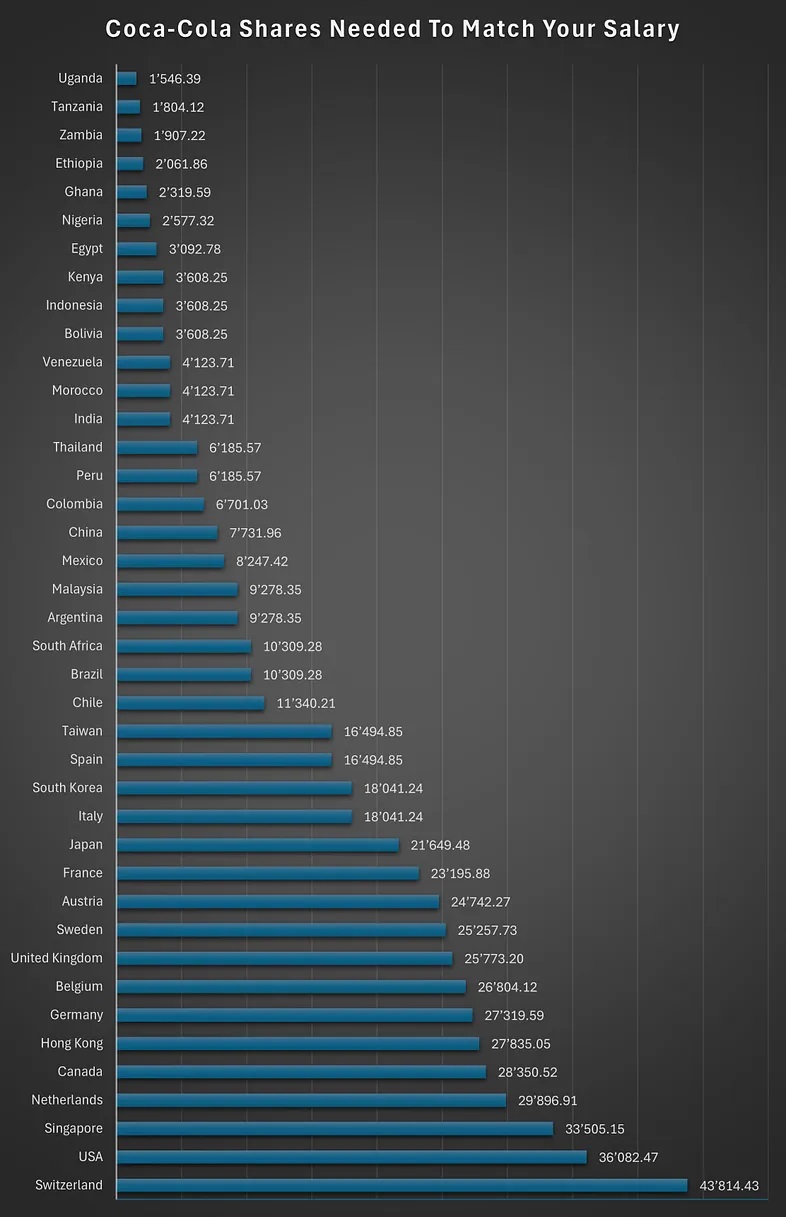

Salaries and Coca-Cola Investment

As of July 2024, Coca-Cola has approximately 4.31 billion shares outstanding. This number represents the total number of shares held by all its shareholders, including both public and private investors (YCharts) (Stock Analysis).As of the writing of the article, the Coca Cola stock has a value of $65.22

What Are the Risks of Investing in Coca-Cola Shares?

- Market and Economic Risks

Investing in Coca-Cola, like any stock, carries inherent market risks. Economic downturns, changes in consumer preferences, and shifts in the global market can all impact Coca-Cola’s performance. While the company has shown resilience over the years, it is not immune to economic recessions or market volatility, which can affect its stock price and dividend payouts. - Competitive Pressure

The beverage industry is highly competitive, with numerous players vying for market share. Competitors like PepsiCo and emerging local brands continually challenge Coca-Cola’s dominance. This competitive pressure can impact Coca-Cola’s sales, profit margins, and ultimately its ability to maintain and grow its dividends. - Regulatory and Legal Risks

Coca-Cola operates in numerous countries, each with its own set of regulations regarding food and beverage safety, marketing practices, and environmental standards. Changes in regulations, such as sugar taxes, restrictions on advertising, or new health guidelines, can affect Coca-Cola’s business operations and profitability. Additionally, legal issues, such as lawsuits related to health claims or environmental impact, can pose financial risks. - Currency Exchange Risks

As a global company, Coca-Cola earns a significant portion of its revenue from international markets. Fluctuations in currency exchange rates can impact the company’s financial performance. A strong U.S. dollar, for example, can reduce the value of Coca-Cola’s international earnings when converted back to dollars, affecting overall revenue and profitability. - Changing Consumer Preferences

Consumer preferences in the beverage industry are continuously evolving. There is a growing demand for healthier, low-sugar, and environmentally friendly products. While Coca-Cola has diversified its product line to include healthier options and invested in sustainability initiatives, failure to keep pace with these changing preferences can lead to a decline in market share and revenue. - Dependency on Bottling Partners

Coca-Cola relies heavily on its global network of bottling partners to manufacture, package, distribute, and sell its beverages. Any disruption in these partnerships, whether due to financial instability of bottlers, disagreements, or operational issues, can impact Coca-Cola’s supply chain and ability to meet market demand. - Stock Price Volatility

Although Coca-Cola is considered a relatively stable investment, its stock price can still be subject to volatility due to market conditions, investor sentiment, or broader economic factors. Investors should be prepared for potential fluctuations in the value of their investment. - Mitigating the Risks

While these risks are inherent, investors can mitigate them by adopting a diversified portfolio strategy, staying informed about market trends, and regularly reviewing their investment positions.

Planning your exit strategy? Here’s the difference between Instagram’s $1B success and Quibi’s flop. Examples, tips, and what to avoid inside.

No MVP? No problem. Here’s how to pitch investors when all you’ve got is a vision and a killer problem to solve.

Don’t wait until it’s too late! If selling your startup is the goal, here’s how to make it exit-ready from the start. Learn the 7 steps to position your business for a dream exit. (Including Pro Tips)

Growth is exciting — until it isn’t. Are you stretching your business too thin? Spot the red flags before it’s too late

Is Early Success Secretly Sabotaging Your Startup? The Hidden Dangers You Need to Know NOW!

Think you need millions in the bank to negotiate like a boss? Think again. Learn how pre-revenue startups can flip the script and win funding deals WITHOUT deep pockets.