Tesla vs. BYD: A Timeline

First a little history, both companies began their journey into electric vehicles around the same time—2003. Tesla was founded with EVs as its core mission from day one, while BYD, already a leader in batteries, entered the auto industry that same year and pivoted toward electrification quickly. The paths diverged, but the timing was remarkably parallel.Tesla

- 2003: Founded by Martin Eberhard and Marc Tarpenning. Elon Musk joins as lead investor.

- 2008: Launch of the original Tesla Roadster.

- 2012: Model S introduced, making luxury electric sedans a reality.

- 2015: Model X launched.

- 2017: Model 3 production begins, aiming for mass market.

- 2020: Tesla becomes the world’s most valuable automaker by market cap.

- 2021-2022: Global expansion accelerates; factories open in Berlin and Austin.

- 2023-2024: Price wars begin. Margins drop. Cybertruck delayed.

- 2025: Deliveries dip, Model Y/3 start to age. Competition rises fast.

BYD

- 1995: Founded as a rechargeable battery company in Shenzhen, China.

- 2003: Enters automotive industry with the acquisition of Qinchuan Auto.

- 2008: Launches the world’s first mass-produced plug-in hybrid, the F3DM.

- 2010s: Dominates electric buses and taxis across China and international cities.

- 2020: Launches Blade Battery technology—a breakthrough in LFP safety and longevity.

- 2022: Stops production of internal combustion engine cars, goes fully electric/hybrid.

- 2023: Surpasses Tesla in total NEV sales.

- 2024: Global sales hit 4.27 million. Expands aggressively into Europe, Asia, and Latin America.

- 2025: Beats Tesla in net income. Grows presence in ride-hailing and commercial fleets worldwide.

BYD vs. Tesla: What the Numbers Really Say

Why start with numbers? Because they cut through noise.EV headlines often obsess over hype—stock swings, CEO tweets, and concept cars. But numbers tell us who’s actually executing. Who’s scaling. Who’s winning.

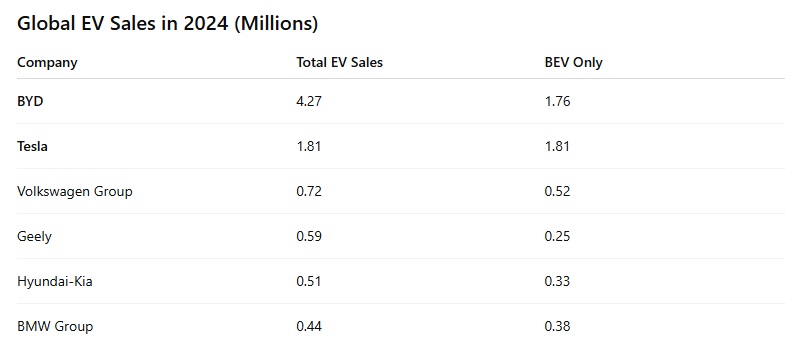

And right now, BYD is putting up serious numbers. (accordingly to EV-Volumes.com – Global EV sales database)

Tesla remains the BEV (Battery Electric Vehicle) leader. But BYD is building dominance through both BEVs and plug-in hybrids—especially in regions where charging infrastructure is patchy. It’s a practical move that’s paying off.

Also worth noting: BYD’s growth isn’t slowing. In Q1 2025, it sold over 1 million vehicles—nearly triple Tesla’s 336,000. That’s no longer a gap. That’s a gulf.

Margins: Who Makes More Per Car?

EV sales are sexy. Margins are serious.

Sources: Q1 2025 Earnings Call, BYD Annual Report 2024

BYD has quietly become a profit machine. Tesla’s margins—once the envy of the industry—have slipped due to price cuts and intensifying competition.

Why it matters: Margins fund the future. Higher profit per unit means more money to reinvest in R&D, better factory tooling, battery innovation, and new model development.

BYD’s vertical integration—producing batteries, chips, and motors in-house—isn’t just a supply chain story. It’s a moat. And as price wars intensify, Tesla’s dependency on suppliers could make its margins more vulnerable than investors like to admit.

Global Footprint: Who’s Really Global?

Sources: Reuters, March 2025

BYD’s presence is expanding rapidly across emerging markets—Africa, Southeast Asia, Central Asia—and increasingly, Europe.

North America is the exception. There, BYD is currently limited to commercial vehicles—buses, forklifts, and delivery trucks. U.S. tariffs, regulatory complexity, and geopolitics have kept them out of the consumer space.

But outside of the U.S.? BYD is showing up in ride-hailing fleets, taxi programs, government EV subsidies, and new middle-class car markets. These are long-term positions—and Tesla isn’t there.

BYD’s Growth Challenges: Branding, Luxury, and Market Access

Brand Recognition: Does It Even Matter? Critics argue that BYD lacks brand recognition outside China. True. But ask yourself: in China and across much of Asia, Africa, and Latin America—do consumers care about badges or price-performance?More importantly: do they even keep cars long enough to care?

In emerging markets, the average holding period is shorter, and reliability + affordability beat status symbols. BYD’s focus on practicality may seem dull to a Western eye—but it’s exactly what’s scaling in developing economies.

BYD’s Other Hurdles

- No U.S. Consumer Sales – For now, a major market remains locked.

- Luxury Segment – BYD’s upmarket brand, Yangwang, is still new. Competing with Tesla or BMW in this space will take years.

- Political Risks – Anti-China sentiment and tariffs could slow expansion in Europe or Australia.

What Tesla Needs to Solve

- Stale Model Lineup – Model 3 and Y still account for 95% of Tesla's sales. But they’re aging. The Cybertruck isn’t mainstream. The Roadster isn’t real. And Robotaxis are years behind schedule.

- Price Cuts Are a Warning Sign – Tesla has slashed prices to stay competitive. But that hurts margins—and signals demand softness.

- The Elon Factor – Musk’s personal brand, once an asset, now polarizes. In politically sensitive markets like Europe, it’s become a drag on Tesla’s perception.

What Tests Are Ahead?

Both Tesla and BYD have clear momentum—but sustaining leadership means overcoming structural, strategic, and perception-based challenges.For BYD:

Can they crack the luxury market?Luxury isn’t just leather seats and big screens—it’s brand heritage, design language, and emotional appeal.

BYD’s Yangwang brand is a start (the U8 SUV made headlines with its crab-walking and water-floating abilities), but credibility in this segment takes time.

To break through, BYD needs halo products, global design talent, and maybe even a European or American design subsidiary that can localize luxury tastes. Partnering with fashion, tech, or motorsport could also accelerate perception shifts.

Can they enter the U.S. without losing cost advantages?

U.S. tariffs on Chinese EVs are high—over 100% as of 2024.

BYD would need to build or partner on local production. That could dilute their cost advantage. One solution? Start small. Commercial vehicles, local assembly of CKD (completely knocked down) kits, or partnerships with U.S. logistics companies could be an entry point. Think Amazon vans or Uber fleets, not Model 3 rivals—at least at first.

Can they build a consumer-facing brand outside Asia?

Right now, BYD’s presence in Europe, Latin America, and Africa is fleet-first. Consumers don’t know the brand yet. The shortcut: word-of-mouth through ride-hailing and taxi networks, combined with aggressive after-sales service and smart marketing.

BYD doesn’t need to be Tesla. It just needs to be seen as smart, reliable, and affordable—and keep showing up where people actually drive.

For Tesla:

Can they launch something new that sticks?Tesla hasn’t launched a mass-market hit since the Model Y. The Cybertruck is polarizing. The Roadster is vapor. The Robotaxi is delayed. Tesla needs a Model 2—a $25K car that can dominate globally.

The fix: Focus on engineering, not showmanship. Forget dancing robots. Deliver a reliable, high-volume, low-cost EV by 2026—and do it in a way that doesn’t cannibalize Model 3/Y sales too early.

Can they stabilize margins?

Tesla's gross margin dropped from above 25% to around 13.6% in just over a year. That's a red flag in any industry. Restoring profitability without constant price cuts requires a combination of battery cost reduction (via 4680 cells or cheaper LFPs), supply chain discipline, and—possibly—less dependence on Elon’s real-time pricing strategies. Volume alone won’t save them if costs aren’t kept in check.

Can Musk focus long enough to deliver a clear, consistent product roadmap?

Elon Musk is Tesla’s biggest asset—and at times, its biggest liability. Between Twitter/X, xAI, SpaceX, and political distractions, Tesla suffers from what some investors now call “founder drift.”

The solution isn’t easy: Either Musk re-focuses on the car business or Tesla empowers a more visible, independent executive team (à la Apple’s Tim Cook model) to execute consistently while Musk stays visionary.

Sustainability & Supply Chain: Who’s Actually Greener?

Tesla built its brand on sustainability—but as scale increases, so do emissions and extraction pressures. It’s deeply invested in lithium refining, Gigafactories, and solar/storage solutions. Its 4680 battery tech promises major improvements—but has faced delays.BYD counters with:

- Full in-house battery production (Blade Battery using LFP tech—no cobalt or nickel).

- Less reliance on rare-earth imports.

- Fleet electrification in cities like Shenzhen and São Paulo.

Neither company is perfect, but BYD’s operational efficiency and LFP chemistry give it a real ESG advantage, especially in the Global South where mineral supply ethics matter more than marketing.

Tesla vs. BYD: Different Innovation Playbooks

Tesla is software-first. Its strength lies in over-the-air updates, its AI-driven Full Self Driving system (still in beta), and ambitious projects like Dojo supercomputers and robotics.BYD is hardware-first. It focuses on safe, scalable battery tech, electric platforms, and vertical manufacturing that keeps costs low. Its innovations may seem less flashy—but they’re more deployable today.

Who’s more innovative? That depends:

- Tesla pushes boundaries.

- BYD builds what works—now.

In the next five years, we’ll see whether consumers want moonshots or mature tech that’s easier to trust.

What Real Consumers Are Saying

Reviews from taxi fleets in Oslo, ride-share users in Chile, and fleet buyers in Thailand all highlight the same thing: BYD cars are “good enough,” often “better than expected,” and “cheap to run.”Tesla fans still praise performance, interior tech, and supercharger access—but are frustrated by service wait times and sudden feature removals.

In a global market where buyers want low maintenance and high uptime, especially in rideshare and urban use, BYD is winning quietly through simplicity and consistency.

Looking Ahead: The 2030 Outlook

Let’s fast-forward.If BYD continues scaling, it may lead in global EV volume across all segments—fleet, commercial, and personal. It might be the Toyota of electric.

Tesla, by contrast, could evolve into a luxury-technology company: smaller in volume but dominant in high-margin autonomous services, energy software, and advanced AI.

It’s not about who wins—it’s about how each adapts. The market is big enough for both. But Tesla must innovate and focus. BYD must brand up and globalize. If either fails at their next test, the balance will shift.

The Investor Perspective: Where’s the Smart Money Going?

As BYD climbs the sales ranks, it's also gaining the attention of global investors. Berkshire Hathaway famously invested in BYD in 2008 and, despite trimming its stake, still holds a position.Tesla, meanwhile, continues to dominate headlines—but in 2024, its stock underperformed the S&P 500, weighed down by shrinking margins and product delays.

Institutional investors now look beyond just vehicle sales. They’re watching:

- BYD’s ability to generate cash flow across a diversified portfolio (buses, trucks, taxis).

- Tesla’s increasing risk from Musk’s public persona and dependence on high-margin autopilot software that isn’t fully rolled out.

Final Thought: My Ride in Kazakhstan Wasn’t a Fluke

The most valuable EV companies in the world used to be ideas. Now, they’re execution machines.Tesla changed the world. But BYD is now changing how the rest of the world drives. Quietly, consistently, and at scale.

That quiet, confident EV in Almaty? It wasn’t just a ride. It was a message: the next global car leader might not speak English first.

That’s the real Tesla threat.

Sam Altman is talking about trillion-dollar AI infrastructure. ChatGPT’s revenues tell a more complicated story.

SaaStr says AI replaced sales. The real reason is buried in the numbers, the business model, and a growth story that isn’t what it used to be.

SpaceX is quietly pushing 4,400 Starlink satellites closer to Earth. It sounds safer — but going lower means faster failures, billion-dollar replacement costs, and a hard limit set by physics. How far can they really go before orbit fights back?

A $2.9 billion Tesla battery deal shrank to just $7,000 in days. Here’s how the 4680 hype, Cybertruck reality, and market mood swings wiped out 99% of its value.

Hermès just overtook LVMH as the world’s most valuable luxury brand—by doing less.

The economics behind it will change how you think about brand strategy.

They didn’t storm the gates — they bought them.

How Goldman Sachs and J.P. Morgan helped China quietly acquire billion-dollar Western companies — and why Trump’s new tariffs could shut the door for good.